SUMMARY

Stripe presents its financial infrastructure solutions that help businesses grow revenue through integrated payment systems and automation tools.

IDEAS:

- Stripe simplifies online and in-person payment processing for businesses of all sizes globally.

- The platform offers various products for managing subscriptions and invoicing efficiently.

- Stripe’s integrated suite reduces costs while enhancing revenue operations for users.

- Businesses can embed financial services easily using Stripe’s APIs and no-code solutions.

- Stripe supports over 135 currencies and payment methods worldwide for diverse business needs.

- The platform enables users to automate finance operations and minimize churn effectively.

- Stripe assists startups in launching and scaling their businesses with flexible financial tools.

- The app marketplace connects Stripe with over a hundred tools for seamless integration.

- Stripe’s fraud prevention features help safeguard transactions against potential threats.

- The company maintains a 99.999% uptime for its services, ensuring reliability for users.

- Businesses using Stripe can access financial accounts and customer financing options.

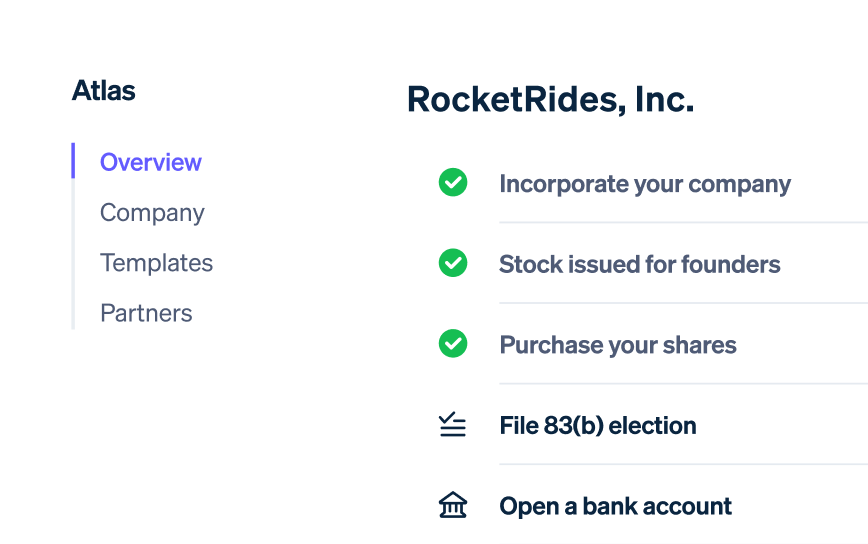

- Stripe allows for easy incorporation of startups through its Atlas program.

- The platform’s prebuilt checkout system optimizes conversion rates for online sales.

- Stripe’s terminal solution facilitates custom in-person payment experiences for retailers.

- Stripe continuously updates its API to adapt to the evolving needs of developers.

- The platform provides a comprehensive documentation resource for developers to utilize.

- Users can leverage Stripe’s analytics tools for generating custom revenue reports.

- Stripe offers integrated pricing models that eliminate hidden fees for users.

- The platform’s global reach makes it suitable for companies aiming for international growth.

- Stripe’s focus on developer experience accelerates the shipping of financial solutions.

- The company’s commitment to sustainability is reflected in its Climate initiative for carbon removal.

INSIGHTS:

- Integrating financial services can significantly enhance a business’s operational efficiency and revenue.

- Automating finance operations reduces manual errors and allows businesses to focus on growth.

- A robust API infrastructure enables seamless integration and adaptability in an evolving market.

- Comprehensive financial solutions are crucial for startups to navigate competitive landscapes successfully.

- Businesses benefit from utilizing platforms that support diverse payment methods and currencies.

- Enhancing customer experiences through optimized checkout processes directly impacts sales performance.

- Reliable service uptime is essential for maintaining trust and efficiency in financial transactions.

- Building partnerships with other platforms enhances service offerings and customer satisfaction.

- Continuous improvement of APIs fosters innovation and keeps services relevant for users.

- Sustainable business practices can be integrated into financial operations without sacrificing profitability.

QUOTES:

- “Join the millions of companies of all sizes that use Stripe to accept payments online.”

- “Use Stripe to handle all of your payments-related needs and manage revenue operations.”

- “Stripe makes moving money as easy and programmable as moving data.”

- “Support recurring business models, minimize churn, and automate finance operations.”

- “Our teams are based in offices around the world and process hundreds of billions of dollars.”

- “Quickly build great payments experiences, improve performance, and engage customers.”

- “The backbone for global commerce, Stripe supports over 135 currencies.”

- “Launch, manage, and scale a commercial card program without setup fees.”

- “Stripe offers low- and no-code options for getting started with payments.”

- “Capture recurring revenue with automated billing solutions tailored to your business.”

- “Stripe helps businesses embed financial services to enhance customer engagement.”

- “The app marketplace connects Stripe to over a hundred tools for seamless integration.”

- “Stripe offers comprehensive documentation for developers to facilitate easy integration.”

- “Build on Stripe Apps to create custom solutions tailored to your specific needs.”

- “Stripe’s fraud prevention features help safeguard transactions against potential threats.”

- “We obsess over the maze of gateways, payments rails, and financial institutions.”

- “Utilize analytics tools for generating custom revenue reports to improve financial strategy.”

HABITS:

- Regularly review and optimize payment processing strategies to enhance revenue generation.

- Utilize Stripe’s analytics tools to track financial performance and customer behavior.

- Implement automated invoicing and billing to reduce administrative overhead.

- Leverage no-code solutions for faster deployment of payment interfaces.

- Maintain up-to-date knowledge of API changes to enhance integration capabilities.

- Foster partnerships with other tech platforms to expand service offerings.

- Focus on customer experience improvements to increase conversion rates.

- Conduct periodic audits of payment methods to ensure relevance and efficiency.

- Incorporate fraud prevention measures into transaction processes as a standard practice.

- Engage with Stripe’s support resources to troubleshoot and resolve issues quickly.

FACTS:

- Stripe processes hundreds of billions of dollars each year for businesses globally.

- The platform supports over 135 currencies and payment methods for international transactions.

- Stripe achieves a historical uptime of 99.999% for its services.

- It handles over 500 million API requests per day, peaking at 13,000 requests per second.

- 90% of U.S. adults have purchased from businesses utilizing Stripe’s services.

- Stripe offers financial accounts and customer financing options to its users.

- The platform’s Atlas program enables startups to incorporate their businesses seamlessly.

- Stripe’s terminal solution provides customizable in-person payment experiences for retailers.

- The company offers low- and no-code options for businesses lacking technical expertise.

- Stripe integrates with over a hundred tools, enhancing its functionality and user experience.

- It provides a comprehensive API reference for developers to utilize effectively.

- The platform allows businesses to manage subscriptions and recurring revenue effectively.

- Stripe’s fraud prevention tools help to secure transactions against potential threats.

- It enables users to automate tax calculations and compliance processes seamlessly.

- Stripe’s Climate initiative focuses on carbon removal and sustainability in business practices.

- The app marketplace facilitates connections between Stripe and third-party applications for users.

- Stripe’s documentation is designed to support developers in integrating its services efficiently.

REFERENCES:

- Stripe Payments

- Stripe Checkout

- Stripe Billing

- Stripe Invoicing

- Stripe Atlas

- Stripe Radar

- Stripe Terminal

- Stripe Connect

- Stripe Treasury

- Stripe API Documentation

- Stripe App Marketplace

- Stripe Support Center

- Stripe Blog

- Stripe Sessions

- Stripe Professional Services

- Stripe Pricing

ONE-SENTENCE TAKEAWAY

Stripe provides integrated financial solutions that enable businesses to grow revenue through efficient payment processing.

RECOMMENDATIONS:

- Explore no-code solutions to integrate payment processing without needing extensive technical expertise.

- Regularly analyze customer data to refine payment strategies and enhance revenue growth.

- Consider using Stripe’s prebuilt checkout options to improve conversion rates effectively.

- Leverage automation tools for invoicing and billing to reduce administrative burdens.

- Build partnerships with other platforms to enhance the scope of services offered.

- Stay updated on industry trends to adapt financial strategies accordingly.

- Use Stripe’s fraud prevention tools to safeguard transactions and maintain customer trust.

- Engage with the Stripe community for support and shared insights on best practices.

- Invest in training staff on Stripe’s tools to maximize their capabilities.

- Test new features and products offered by Stripe to maintain a competitive edge.

Title: Stripe | Financial Infrastructure to Grow Your Revenue

URL Source: https://stripe.com/

Markdown Content:

Stripe | Financial Infrastructure to Grow Your Revenue

- Products

- Solutions

- Developers

- Resources

- Pricing

Back

- Products

- Solutions

- Developers

- Resources

- Contact sales

- Pricing

Global payments

- Payments Online payments

- Payment Links No-code payments

- Checkout Prebuilt payment form

- Elements Flexible UI components

- Terminal In-person payments

- Radar Fraud prevention

- Authorization Acceptance optimizations

Embedded payments and Finance

- Connect Payments for platforms

- Treasury Financial accounts

- Capital Customer financing

- Issuing Physical and virtual cards

Revenue and Finance Automation

- Billing Subscriptions and usage-based

- Revenue Recognition Accounting automation

- Tax Sales tax & VAT automation

- Invoicing Online invoices

- Sigma Custom reports

- Data Pipeline Data sync

More

- Payment methods Access to 100+ globally

- Link Accelerated checkout

- Financial Connections Linked financial account data

- Identity Online identity verification

- Atlas Startup incorporation

By stage

By business model

By use case

Ecosystem

Get started

Guides

- Accept online payments

- Manage subscriptions

- Send payments

- Full API reference

- API status

- API changelog

- Build on Stripe Apps

- Support center

- Support plans

- Guides

- Customer stories

- Blog

- Sessions

- Contact sales

- Jobs

- Newsroom

- Stripe Press

- Become a partner

Global payments

- Payments Online payments

- Payment Links No-code payments

- Checkout Prebuilt payment form

- Elements Flexible UI components

- Terminal In-person payments

- Radar Fraud prevention

- Authorization Acceptance optimizations

Embedded payments and Finance

- Connect Payments for platforms

- Treasury Financial accounts

- Capital Customer financing

- Issuing Physical and virtual cards

Revenue and Finance Automation

- Billing Subscriptions and usage-based

- Revenue Recognition Accounting automation

- Tax Sales tax & VAT automation

- Invoicing Online invoices

- Sigma Custom reports

- Data Pipeline Data sync

More

- Payment methods Access to 100+ globally

- Link Accelerated checkout

- Financial Connections Linked financial account data

- Identity Online identity verification

- Atlas Startup incorporation

By stage

By business model

By use case

Ecosystem

- Stripe App Marketplace

- Partners

- Professional services

- Documentation Start integrating Stripe’s products and tools

Get started

Guides

- Accept online payments

- Manage subscriptions

- Send payments

- Set up in-person payments

- Full API reference

- API status

- API changelog

- Build on Stripe Apps

- Support center

- Support plans

- Guides

- Customer stories

- Blog

- Sessions

- Contact sales

- Jobs

- Newsroom

- Stripe Press

- Become a partner

Sessions 2025 • Early-bird registration now open

Financial infrastructure to grow your revenue

Financial infrastructure to grow your revenue

Financial infrastructure to grow your revenue

Join the millions of companies of all sizes that use Stripe to accept payments online and in person, embed financial services, power custom revenue models, and build a more profitable business.

Rocket Rides

Search

Today

Net volume

$3,528,198.72

2:00 PM

Yesterday

$2,931,556.34

12:00 AM Now, 2:00 PM 11:59 PM

USD Balance

$553,257.51

Available to pay out

View

Payouts

$102,633.07

Expected today

View

Net volume from sales +32.8%

$39,274.29 $29,573.54

Apr 20 Today

Updated today 7:50 AM

New customers +32.1%

37 28

Apr 20 Today

Updated today 7:50 AM

Invoices

Paid

$25,000.00

Open

$20,000.00

Past due

$1,000.00

Updated today 7:50 AM

Abstraction Magazine

$19 per month

Or pay with card

Card Information

Number

MM / YY

CVC

Country or region

United States

ZIP

Pay

Cancel

Chase Freedom (•••• 1234)

27 Fredrick Ave Brothers OR

Billing

John Appleseed

27 Fredrick Ave

Brothers, OR 97712

United States

Contact

j.appleseed@example.com

+1 (458) 555-2863

Pay total

$65.00

Mousedown/⌘FF/Rewind

Right/leftStretch

Up/downAmplitude

-/+Zoom

PPause/play

1Red on/off

2Blue on/off

3Yellow on/off

4Purple on/off

Modular solutions

A fully integrated suite of financial and payments products

Reduce costs, grow revenue, and run your business more efficiently on a fully integrated platform. Use Stripe to handle all of your payments-related needs, manage revenue operations, and launch (or invent) new business models.

Wood Chair 001

$149

€135.00

¥199.00

€135.00

$149

Pay $149

€135.00 zahlen

支付 ¥199.00

Betaal €135.00

Pay $149

Quantum

Abstraction

Typographic

Quantum

Products

Pricing

Contact

Standard

Up to 5 users

$49/month

Subscribe

This includes:

12 months historical data

4 hr data refresh

500+ third party integrations

Professional Popular!

Up to 25 users

$149/month

Subscribe

This includes:

24 months historical data

1 hr data refresh

1,000+ third party integrations

Simple reporting

Enterprise

Unlimited users

$299/month

Subscribe

This includes:

Unlimited historical data

15 min data refresh

2,000+ third party integrations

Advanced reporting

Priority support

Basic

Digital access

$9/month

Subscribe

This includes:

Unlimited access to web content

Exclusive subscriber content

Premium Popular!

Digital and print access

$19/month

Subscribe

This includes:

Unlimited access to web content

Monthly print issues

Exclusive subscriber content

Web

50-499 users

$99/month

Subscribe

This includes:

Up to 3 fonts

50k requests

5 domains

Unlimited seats

9125

Hanako Yamada

Processing

Completed

$150.00

9124

Jacques Muller

Processing

Completed

$200.00

9125

Hanako Yamada

Processing

Completed

$150.00

9124

Jacques Muller

Processing

Completed

$200.00

$150.00

$200.00

$145.50

$194.00

$4.50

$6.00

Buyers

Platform

Sellers or service providers

Orders

Today

Yesterday

Older than 2 days

9125 Hanako Yamada

Processing

$150.00

9124 Jacques Muller

Processing

$200.00

9123 John Appleseed

On Hold

$178.00

9122 Jane Diaz

Completed

$200.00

9121 Anna Nowak

Completed

$200.00

9120 Wei Qing

Completed

$156.00

My store Orders Products Reviews

Payments

Accept and optimize payments, globally

Increase authorization rates, optimize your checkout conversion, and offer local payment methods in every market.

See also

Tax for automating sales tax and VAT

Radar for fraud prevention and management

Terminal for custom in-person payments

Wood Chair 001

$149

€135.00

¥199.00

€135.00

$149

Pay $149

€135.00 zahlen

支付 ¥199.00

Betaal €135.00

Pay $149

Billing

Capture recurring revenue

Support recurring business models, minimize churn, and automate finance operations.

See also

Invoicing for invoice creation, collection, and tracking

Revenue Recognition for streamlined accrual accounting

Sigma for custom revenue reports

Quantum

Abstraction

Typographic

Quantum

Products

Pricing

Contact

Standard

Up to 5 users

$49/month

Subscribe

This includes:

12 months historical data

4 hr data refresh

500+ third party integrations

Professional Popular!

Up to 25 users

$149/month

Subscribe

This includes:

24 months historical data

1 hr data refresh

1,000+ third party integrations

Simple reporting

Enterprise

Unlimited users

$299/month

Subscribe

This includes:

Unlimited historical data

15 min data refresh

2,000+ third party integrations

Advanced reporting

Priority support

Basic

Digital access

$9/month

Subscribe

This includes:

Unlimited access to web content

Exclusive subscriber content

Premium Popular!

Digital and print access

$19/month

Subscribe

This includes:

Unlimited access to web content

Monthly print issues

Exclusive subscriber content

Web

50-499 users

$99/month

Subscribe

This includes:

Up to 3 fonts

50k requests

5 domains

Unlimited seats

Connect

Set up multiparty payments and payouts

Integrate payments into your platform or marketplace for end-to-end payments experiences.

See also

Terminal for custom in-person payments

Instant Payouts for fast payments to users

Payment Elements for customizable UIs

9125

Hanako Yamada

Processing

Completed

$150.00

9124

Jacques Muller

Processing

Completed

$200.00

9125

Hanako Yamada

Processing

Completed

$150.00

9124

Jacques Muller

Processing

Completed

$200.00

$150.00

$200.00

$145.50

$194.00

$4.50

$6.00

Buyers

Platform

Sellers or service providers

Orders

Today

Yesterday

Older than 2 days

9125 Hanako Yamada

Processing

$150.00

9124 Jacques Muller

Processing

$200.00

9123 John Appleseed

On Hold

$178.00

9122 Jane Diaz

Completed

$200.00

9121 Anna Nowak

Completed

$200.00

9120 Wei Qing

Completed

$156.00

My store Orders Products Reviews

Issuing

Build a fintech offering with banking-as-a-service

Launch, manage, and scale a commercial card program without any setup fees.

See also

Treasury for financial accounts

Capital for offering fast, flexible financing

Connect for powering platform payments

Global scale

The backbone for global commerce

Stripe makes moving money as easy and programmable as moving data. Our teams are based in offices around the world and we process hundreds of billions of dollars each year for ambitious businesses of all sizes.

500M+

API requests per day, peaking at 13,000 requests a second.

99.999%

historical uptime for Stripe services.

90%

of U.S. adults have bought from businesses using Stripe.

135+

currencies and payment methods supported.

Enterprise reinvention

Bring agility to your enterprise

Quickly build great payments experiences, improve performance, expand into new markets, and engage customers with subscriptions and marketplaces. Get expert integration guidance from our professional services team and certified partners, and connect Stripe to Salesforce, SAP, and more through the Stripe App Marketplace.

Explore Stripe for enterprises

Millions

BMW owners using ConnectedDrive Store

350+

US dealerships

Products used

- Payments

- Connect

5+

Amazon businesses on Stripe including Prime, Audible, and Amazon Pay.

50+

Payment methods available on Stripe

Products used

- Payments

- Connect

130

Countries in logistics network

$10+

Billion worth of goods moved around the world each year

Products used

- Payments

- Connect

+5.5%

Uplift from Stripe’s Global Payments Infrastructure

+1%

Uplift from Adaptive Acceptance

Products used

- Payments

- Sigma

Read story Learn why BMW chose Stripe to power ecommerce and payments ==========================================================Read story See how Amazon simplified cross-border payments with Stripe ===========================================================Read story See how Maersk tapped into new technology to make it easier to ship around the world ====================================================================================Read story See how Twilio increased authorization rates by 10% with Stripe ===============================================================

Built for growth

Take your startup farther, faster

Startups build on Stripe to launch faster, adapt as they grow, and automate workflows to do more with less. Build your own API-based integration or use our low- to no-code solutions, which are simple enough for easy implementation and powerful enough to scale as fast and as far as you need.

Atlas

Incorporate your company

Form a legal entity, issue stock, and start accepting payments.

jane.diaz@example.com

Card information

1234 1234 1234 1234

MM/YY

CVC

Name on card

Jane Diaz

Country or region

United States

Checkout

Sell to consumers

Launch a B2C business with a prebuilt payment page that’s optimized for conversion.

👋 anything I can help with today?

Hey, can I buy a license just for myself?

Sure, in that case I’d recommend our starter plan.

buy.stripe.com/Ae93Jis

$19.99 per item

Scan to pay

Payment Links

Validate your idea

Test your product idea by launching payments with little to no code.

$144.78

Due Feb 19

To Jenny Rosen

From Powdur

Memo Note this includes nine editors and unlimited projects.

View invoice details

Invoicing

Sell to businesses

Launch a B2B business and collect one-time or recurring payments from customers.

Designed for developers

Ship more quickly with powerful and easy-to-use APIs

Save engineering time with unified payments functionality. We obsess over the maze of gateways, payments rails, and financial institutions that make up the global economic landscape so that your teams can build what you need on one platform.

~NORMAL

server.js

100%

☰

0/1

ln

:

1

$$ []

Use Stripe with your stack

We offer client and server libraries in everything from React and PHP to .NET and iOS.

Try no-code options

Customize and deploy payments interfaces directly from the Stripe Dashboard.

Explore prebuilt integrations

Connect Stripe to over a hundred tools including Adobe, Salesforce, and Xero.

Build on Stripe Apps

Create an app just for your team or for the millions of businesses on Stripe.

Launch with ease

Low- and no-code options for getting started

If you’d like to use Stripe for your business but don’t have developers on staff, no problem. We have a few options depending on your needs.

Use a pre-integrated platform

Explore our directory to find out-of-the-box solutions that connect with Stripe, such as Squarespace and Lightspeed.

Build with Stripe-certified experts

Work with a Stripe consulting partner that can integrate and deploy Stripe solutions for you.

Brand elements

Customize how your brand appears globally across the Stripe products your customers use.

Icon

Logo

Brand color

F5F0EA

Accent color

262627

Try our no-code products

Create an invoice, accept an in-person payment with your phone, or share a payment link directly from your Dashboard to start generating revenue in minutes—no code required.

Ready to get started?

Create an account instantly to get started or contact us to design a custom package for your business.

Always know what you pay

Integrated per-transaction pricing with no hidden fees.

Start your integration

Get up and running with Stripe in as little as 10 minutes.

United States (English)

Australia

Austria

Belgium

Brazil

Bulgaria

Canada

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Finland

France

Germany

Gibraltar

Greece

Hong Kong

Hungary

India

Ireland

Italy

Japan

Latvia

Liechtenstein

Lithuania

Luxembourg

Malaysia

Malta

Mexico

Netherlands

New Zealand

Norway

Poland

Portugal

Romania

Singapore

Slovakia

Slovenia

Spain

Sweden

Switzerland

Thailand

United Arab Emirates

United Kingdom

- United States

Products & pricing

- Pricing

- Atlas

- Billing

- Capital

- Checkout

- Climate

- Connect

- Data Pipeline

- Elements

- Financial Connections

- Identity

- Invoicing

- Issuing

- Link

- Payments

- Payment Links

- Payouts

- Radar

- Revenue Recognition

- Sigma

- Tax

- Terminal

- Treasury

Solutions

- Startups

- Enterprises

- SaaS

- Platforms

- Ecommerce

- Marketplaces

- Crypto

- Creator economy

- Embedded finance

- Global businesses

- Finance automation

Integrations & custom solutions

Developers

Resources

- Guides

- Customer stories

- Blog

- Annual conference

- Privacy & terms

- Prohibited & restricted businesses

- Licenses

- Sitemap

- Cookie settings

- Your privacy choices

Company

Support

- Contact sales

- Support center

- Support plans

- CA residents: +1 888 926 2289

- © 2024 Stripe, Inc.